NEWS RELEASE January 2020

Valve Market Share Analysis for 140 Companies

The McIlvaine market share analysis for each valve supplier is valuable for those companies considering acquisitions, divestiture or seeking to increase share organically. This continually updated database and analysis is part of Industrial Valves: World Markets https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

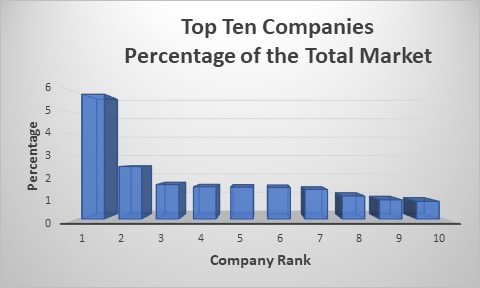

There have been a number of mergers, acquisitions, divestitures, and joint venture agreements undertaken by valve companies in the last three years. Emerson has been the most active. The purchase of the valve operations of Pentair (Tyco) the largest valve producer made Emerson the # 1 producer. In the latest 12 months sales are estimated close to $3.8 billion compared to $1.6 billion for # 2 Cameron Schlumberger. The largest divestiture was the GE sale of stock in BHGE to the now independent Baker Hughes with valve sales of $960 million.

Market shares are being continuously revised to provide worldwide rankings of valve sales by company and further segmented by corporate location.

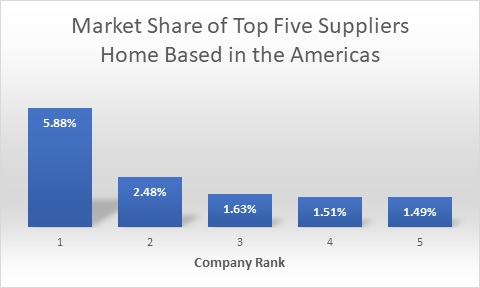

Of the top six ranked suppliers, five are home based in the U.S. Their sales are equal to 15 percent of the world market. There sales equal well over 50 percent of the U.S. market. Their success has come from penetration of the markets in the other two regions.

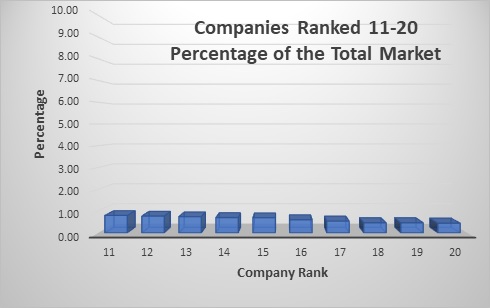

This low percentage reflects the smaller size of the Asian valve companies. However, their growth rate is higher and we can expect these percentages to increase.

Emerson is home based in the U.S. with 2019 valve sales of $3.79 billion its market share on a worldwide basis is over 5%. However, this is equal to18% of the market in the Americas. The fact that Emerson has penetrated the Asian and EMEA markets has allowed the company to grow even if it would be very difficult to achieve an 18% share on the continent in which it resides. On the other hand, Neway has a 0.7% of the total world market. All of its sales represent only 1.6% of the Asian market. It is growing internationally. But even if it were not it still las lots of opportunity in Asia.

Whether a valve company is selling, buying, or seeking organic growth and higher profits, the knowledge of valve company market shares is important.

- Selling: In general, another valve company with synergisms will pay more for a valve supplier than will a private equity investor. This continuing analysis of market shares is a good way to select potential acquirers.

- Buying: The analysis of market shares is very important to valve company acquirers. This analysis should really be just the starting point. Market shares by specific product, process, industry, and location are each significant. While market share for all valves in Asia is part of the report, it is possible to expand this to market share for turbine bypass valves for coal fired power plants in India.

- Organic growth: Sales are not made in a vacuum. Expanding sales means taking share away from some of the existing suppliers. So, a market share analysis is the starting point and also a continuing effort. The competitor share knowledge is important for many throughout the organization including the local salesperson. As competitors merge and gain share it is important to track these changes.

- Higher profits: The # 1 and # 2 suppliers in a given market have the potential for higher profits due to efficient use of resources. Analyzing the profitability of competitors provides insights on how to raise profits. The starting point is market shares.

The market share analysis reviews recent acquisition attempts as well as hedge fund led divestiture attempts to compare the goals of those seeking change to the performance of their targets.

For more information click on Industrial Valves: World Markets https://home.mcilvainecompany.com/index.php/markets/water-and-flow/n028-industrial-valves-world-market

Bob McIlvaine an answer your questions at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 226 2391