NEWS RELEASE March 2019

Hydraulic Fracturing Presents a Most Profitable Market Opportunity for CFT Product and Service Companies

The hydraulic fracturing market offers the opportunity for combust, flow and treat (CFT) suppliers to generate large unit margins and substantial gross profits by creating products with lower total cost of ownership. This is due to the severe and critical service requirements as well as rapidly evolving technology.

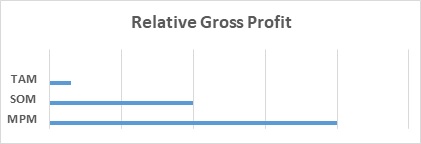

McIlvaine is offering a service to help suppliers quantify the market in terms of the obtainable gross profit at various prices levels resulting in the revenue and gross margin combination to provide the Most Profitable Market (MPM).

The market is large and will grow at close to double digit rates in the coming years. Because the frac sand manufacturing plants are now being built near fracking sites and because many of the same CFT products are used in both the two markets can be treated as one. The Total Available Market (TAM) is $70 billion per year for all CFT products and services.

The pump and valve TAMs are each in excess of $3 billion per year. There are very large markets for instrumentation, software, dust collection, liquid filtration, sedimentation, centrifugation, dryers, conveyors and screens.

The Serviceable Obtainable Market (SOM) is the market which can be addressed with the lowest priced product at even small unit margins. The Most Profitable Market (MPM) is the one for which the supplier can most profitably supply its products and services given its capital and knowledge resources.

Hydraulic fracturing offers a large and fast growing MPM for CFT manufacturers. New developments in the last month will cause a large increase in fracking sales. It now is a good bet that the U.S. will produce 25 million bbl/day of liquids by 2025. The oil companies are saying that OPEC and IEA are wrong. They are setting their capital budgets on this premise.

OPEC expects shale growth to slow after 2023, causing U.S. output to peak at 14.3 million barrels a day by 2028. OPEC then expects U.S. production to fall to an average of 12.1 million barrels a day by 2040. IEA expects shale production to plateau in the mid-2020s, ultimately falling by 1.5 million barrels a day in the 2030s due to resource constraints.

Exxon and Chevron, now two of the most significant players in the Permian, are much more optimistic even under lower oil price scenarios. The two majors are expected to produce close to 2 million barrels of oil equivalent a day combined from the Permian by the mid-2020s, effectively tripling their 2018 output. Chevron plans to increase production to 600,000 barrels a day by 2020, reaching 900,000 barrels a day by 2023. Exxon, meanwhile, expects its Permian production to hit 1 million barrels a day by 2024.

Shale investment is low and the returns are seen very quickly. Exxon reports that wells in the Permian are capable of delivering returns of more than 10 percent at an oil price as low as $35 a barrel. Chevron owns most of its land outright and is looking at even higher returns. Both companies see continuing growth past 2025 due to the fact that the amount of oil recovered to date is less than 10 percent of the potential.

Royal Dutch Shell and BP are also building prominent positions in the Permian. This group has the financing to create the necessary infrastructure including pipelines for production of associated natural gas. They can also invest in the refineries and petrochemical facilities to process the surplus of light, sweet crude and associated gas that shale basins generate. It is therefore likely that U.S. liquids production could reach 25 million barrels/day by 2025 at a price of $55/barrel and that it will not nosedive thereafter.

The international market is looking very promising. The major oil companies are pursuing opportunities in South America and China. Saudi Arabia is pursuing hydraulic fracturing for gas extraction. The purpose is to generate power with gas turbines instead of oil fired boilers.

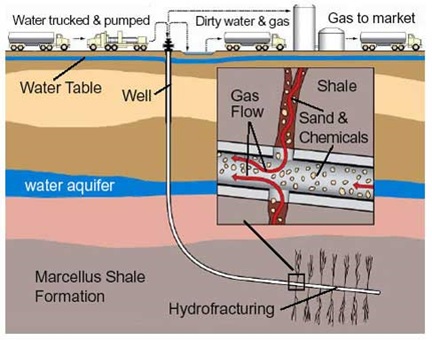

Hydraulic fracturing processes utilize pumps for chemical blending and treatment of water which flows back as a result of the fracking operation. The big market is in the actual pumping of proppant into wells. This fluid which consists of sand, water, and chemical additives is pumped at very high pressures. The purpose is to create fractures in the shale. Oil then flows through these fractures to the surface.

These large pumps are typically installed on trucks which can then move to another site once the fracturing process has been accomplished. Due to the pressures and abrasive nature of the fluid, the wear rates on pump parts are measured in months and not years. When downtime, labor, and part costs are considered the costs are high. There is a large potential for a company to design a superior pump. Even with a high unit margin the company can generate a large sales volume if it can demonstrate the lowest total cost of ownership. Given the size of the market the company with a superior product can pursue a very large MPM.

Weir is one pump manufacturer pursuing this course. The Weir SPM® QEM 3000 is designed to extend maintenance cycles by a factor of three as compared to what operators are achieving in similar service conditions currently. This includes expanding traditional frac pump life span to improve uptime and productivity while reducing maintenance costs and total cost of ownership (TCO) by at least 17 percent. Note that this 17 percent differential would be a conscious decision by Weir to price its pumps to maximize gross profit. A 17 percent differential is sufficient to create a large market share.

What is the Most Profitable Market (MPM)? The TAM is well over $1 billion/yr. Can Weir validate a three times longer life for parts? If so what is the pump cost compared to competitors? Where should the price be set? At a 17 percent TCO advantage Weir might achieve a 20 percent market share. If it raises prices 7 percent it may reduce its total revenue but may still have a larger MPM gross profit. So there is the need to evaluate the variables and determine how to obtain the largest MPM gross profit.

Another example is valves. Cameron claims that its frac sand gate valves have three times the uptime of competitor designs. When you take into account downtime, labor, and repair part costs what is the difference in total cost of ownership for valves if prices are the same as competitors? Once this differential is established the price to maximize MPM gross profit can be set.

IAC has a new dual feed rotary dryer which uses the moisture in the trim feed to cool hot sand. This increase in efficiency provides substantial energy savings along with other benefits. The TCO needs to be compared to other rotary designs as well as to fluid bed designs and the Optimum MPM program adopted.

Frac sand plants are changing their requirements and are requiring finer sands as well as better uniformity in size percentages. Wet and dry screens are therefore critical components. Screen life is measured in months. This results is big differences in total cost of ownership and opportunities for high gross margins.

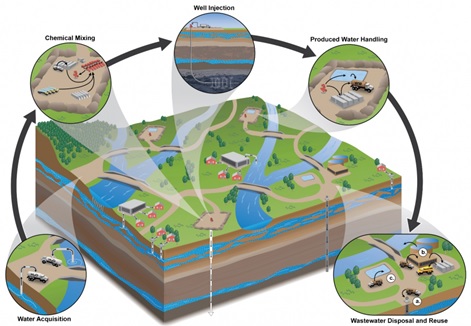

The frac sand manufacturing plants and the hydraulic fracturing operations both have water challenges. Often both are competing for available water. Both need to maximize water reuse.

HYDRAULIC FRACTURING WATER CYCLE

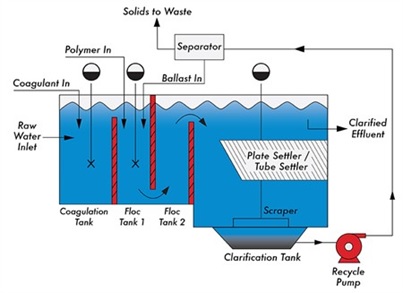

Wastewater treatment involves chemicals, filtration and other separation processes as shown in the Anguil frac sand water reuse system.

There are many opportunities for water treatment system providers as well as suppliers of chemicals, pumps, and filters to provide products with a lower total cost of ownership.

The market opportunity for treatment chemicals suppliers will grow faster than the overall market. The development of slickwater and the use of various quantities of fluids at varying pressures all depend on the chemical combination which is selected.

The goal of the CFT company is to increase profits. Unless the company creates reliable MPM forecasts, it may place too much emphasis on SOM. This results in lower gross profit.

The McIlvaine Program

McIlvaine will provide custom forecasts of the SOM and MPM for any product. These can be supplied by country, process and even by individual owner. Purchases by Exxon Mobil, Chevron, Shell, Schlumberger, Saudi Aramco, Sinopec, Covia and Preferred Sands can be forecast. Site specific impacts on total cost of ownership can be considered.

Typically the assignment will include access to N049 Oil, Gas, Shale and Refining Markets and Projects and to the applicable product market report http://home.mcilvainecompany.com/index.php/markets.

It also includes Frac Sand Decisions 204I Frac Sand Plant CFT Decisions

Every company should strive to maximize the sales of higher performance products and services. Its R&D should be oriented to increasing the number of products with high margins due to their lowest total cost of ownership (LTCO). It should also be striving to increase the amount of its LTCO over competitive products. This will result in higher gross profit. The opposite side of this coin is that the competition will be striving to do the same. So the LTCO is always a function of the differential to all of the competitors. Therefore LTCOV needs to be a continuous effort. Changes in the MPM need to be quickly addressed by all the involved disciplines.

For more information contact Bob Mcilvaine at: bob.mThis email address is being protected from spambots. You need JavaScript enabled to view it. or call him at 847 226 2391.