NEWS RELEASE January 2020

Determining Flow and Treat Market Shares and Rankings

Flow and treat suppliers set a high priority on determining the market share for their products as well as their ranking among competitors. There is promotional as well as strategic value. The research needed to generate promotional value is modest. The research needed to maximize the strategic value is considerable.

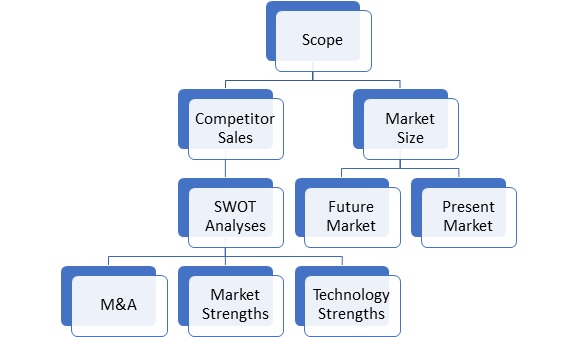

Scope: To create promotional value it is relatively easy to pick a market scope which favors the company. To create strategic value it is desirable to carefully assess the following definitions

- Product which is being evaluated

- Application

- Industry

- Process

- Medium (gases, liquids, free flowing solids)

- Geographic scope

- Time frame

- Customers (the largest purchasers with centralized flow and treat purchasing are larger customers than half the countries of the world.)

Market Share and Rankings Analysis Needs

Market Size: The true market size often requires understanding of the industries, the applications and even the equipment choices. What percentage of sewage sludge is dewatered in belt filter presses, centrifuges, or recessed chamber filter presses? If you sell filter cloths or filter belts this is an important investigation.

Determination of the future market is very important. If the supplier can gain market share in an expanding market the impact on revenues is substantially greater than gaining market share in a stable or shrinking market.

Competitor Sales: It is desirable to not only assess the present sales of the major competitors but also predict their future sales and market shares. This requires considerable effort but there are multiple values. McIlvaine analyzes the participation of flow and treat companies in hundreds of exhibitions around the world. Some are industry oriented such as ACHEMA. Some are equipment oriented such as Valve World or FILTXPO. Exhibitions such as PowerGen are held in Asia, the U.S. and Europe. So insights on geographical strategy can also be ascertained.

It is also desirable to conduct SWOT analyses for major competitors and to assess their product development activity. The McIlvaine company has services on air pollution control, water pollution control, combustion, drying, separation and other processes which provide unique insights on product development progress and needs.

Market share is impacted by mergers and acquisitions which are resulting in larger and larger companies with increasing market share. Suppliers need to keep analyzing the consequence of a merger among competitors. In some cases market ranking may drop but market share will increase. For example two smaller competitors could merge but then their combined sales do not reach the level that they would have reached as independent companies.

With the broad range of market and technical services offered the McIlvaine Company is uniquely qualified to assist flow and treat companies with market share and ranking analysis. For more information contact Bob McIlvaine at 847 784 0013 or This email address is being protected from spambots. You need JavaScript enabled to view it..