NEWS RELEASE October 2020

Filter Media Market will be Large but Volatile

The segments of the filtration industry which use non-woven and membrane filters were $60 billion in 2019. If the lowest true cost choices relative to the coronavirus are selected the market will grow to $80 billion in 2022. This represents an increase of 33 percent over the 2019 revenues.

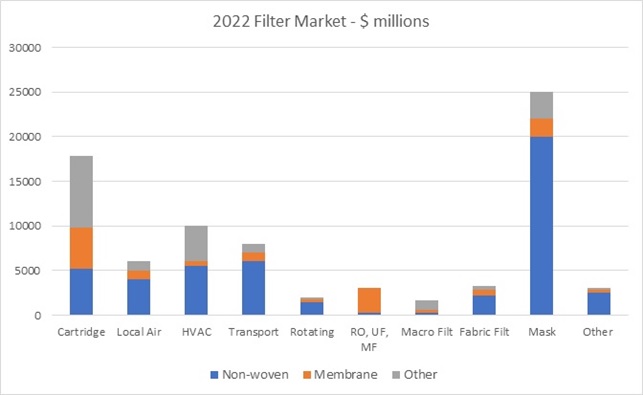

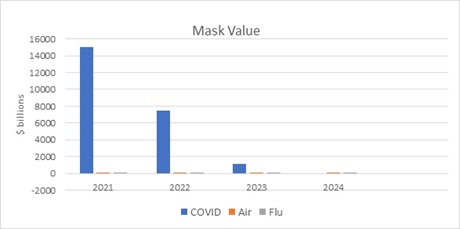

Coronavirus variables have the biggest effect on the mask, local air and HVAC purchases. Given the lowest true cost path the media purchases for masks would be over $5 billion. The media purchases for local air and HVAC would be $4 billion. Media purchases for other filtration applications would be over $21 billion.

The lowest true cost analysis recognizes the fact that most virus transmission is through small aerosols. As a result highly efficient masks and filters represent the lowest true cost.

Media suppliers are investing in production lines which will be depreciated over many years. So the market past 2022 is of high interest. The future markets are dependent upon

- choice of the lowest true cost program or the choice the U.S. and Brazil have taken

- the timing and impact of vaccines and therapies

- the impact of the next pandemic, influenza and air pollution

- the development of new media with higher performance attributes

- existing capacity versus demand at any point in time.

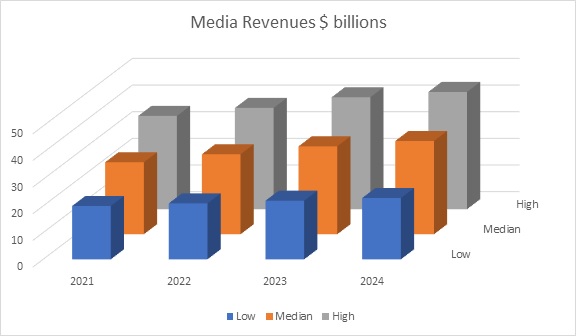

The filtration media suppliers are facing the challenge of a very volatile market. The 2021 market could vary from $20 to $35 billion. By 2024 the market could vary from $23 billion to $44 billion.

Media suppliers will be well advised to continually adjust forecasts in each application and geography. Some applications such as rotating equipment have much more certainty than masks.

The same media which can be used in masks and HVAC filters has applicability in gas turbine intake filters, dust collectors, and liquid cartridges.

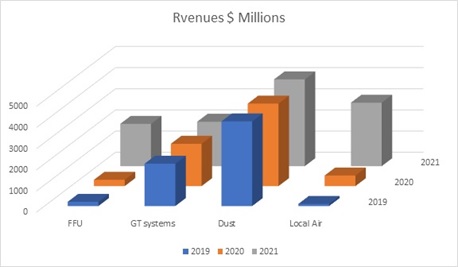

Growth in gas turbine inlet filters and dust collection will be much more predictable than media for fan filter units and local air systems.

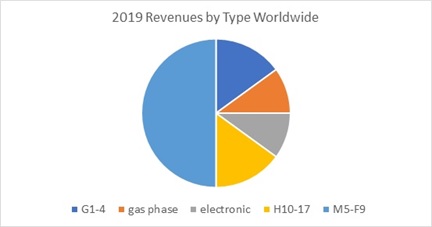

Media efficiencies will change substantially from this 2019 split.

The COVID impact will likely lessen but air pollution and influenza concerns will insure a continuing market.

The Mcilvaine Company has custom reports on filter media and multi client reports on each filtration application. Details are found at www.mcilvainecompany.com Bob McIlvaine can answer any questions at This email address is being protected from spambots. You need JavaScript enabled to view it. or 847 226 2391.