NEWS RELEASE January 2021

Huge Changes in the Filter and Filter Media Markets

Any forecasts for filter and filter media revenues are likely to be outdated within months. The reason is that major changes are taking place in the industry at an unprecedented rate. Drivers include

- The coronavirus pandemic

- Wildfires, drought, and global warming

- Nationalism replacing international cooperation and trade

- New fibers and media

- Opportunities in gas phase removal for particulate filters

- Process and safety justification of higher filtration efficiency

- Water reuse

- The campaign to eliminate coal fired power generators

- Cost of recovery of oil from shale

- Single use systems for biopharmaceuticals

There is presently a shortage of MERV 13 filters as buildings try to comply with COVID regulations. The MERV 13 media can also be used in many other applications. Meltblowns, nanofibers, other non wovens and membranes are all competing options in a number of gas and liquid applications.

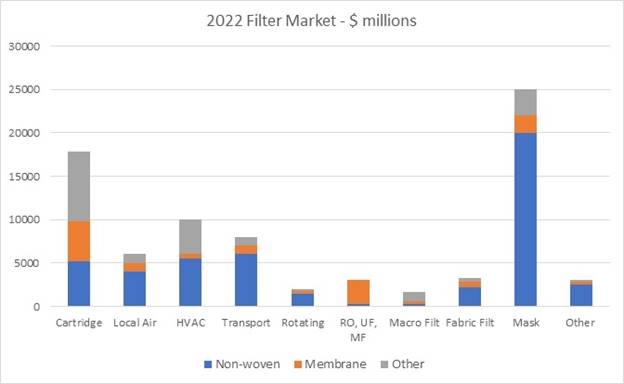

This graph prepared a few months ago may be made obsolete due to a safe bubble initiative which could result in billions of people wearing highly efficient masks. This would make the short term mask market the largest segment in the history of filtration.

There is the possibility to actually suck the CO2 out of the air using the Drax concept and possibly even shale fracturing with CO2 generated from biomass combustion.

A new class of inexpensive ambient air and liquid monitors allows measurement of individual toxic elements such as cadmium. This in turn drives the market for more efficient filters to eliminate these elements in the environment.

There are major changes in geographical activity as well as market shares for the suppliers and end users. Who would have predicted the problems of GE and ExxonMobil or the rise of Sinopec who in just eight weeks became one of the world’s largest meltblown suppliers.

Suppliers of filters and media are challenged to identify the low hanging fruit which needs to be immediately picked but also the high insect free fruit which ultimately result in the largest profits.

McIlvaine has a way to clear the fog and obtain the latest insights on the market. An hour long webinar shows participants the size of any of the markets they select.

This is accompanied by an explanation of the geographical, process, and regulatory drivers. Discussion among participants is also encouraged

The cost of the webinar is offset by discounts when any of the market reports are purchased within the following 90 days.

For more information on the webinars contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it. or 847 226 2391

Information on specific market reports is displayed under markets at www.mcilvainecompany.com