NEWS RELEASE August 2023

Suppliers Need to Provide the Value Propositions to OEMS, AE’s and Distributors

Suppliers should prepare value propositions showing why their product should be selected for a particular locality, application, and product in every niche. The use by distributors can be very effective.

The value to the supplier and purchaser is clear. The problem has to be specified and the details of the solution need to be included. This solution is comparative. The contrast can be to doing nothing or buying from a competitor. Mcilvaine is posting value propositions to help purchasers with their decisions.

The value proposition includes both the problem and solution. Typically, the purchaser understands the problem better than the supplier. That is not always true. Gas turbine suppliers who are remotely continually monitoring turbine parameters at thousands of sites have insights that the individual purchasers do not have.

The marketers include the various types of distributors including solutions, convenience and catalog. The influencers include architect / engineers and OEMs who include the products.

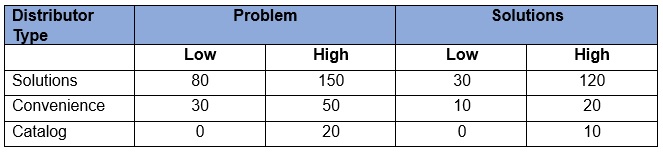

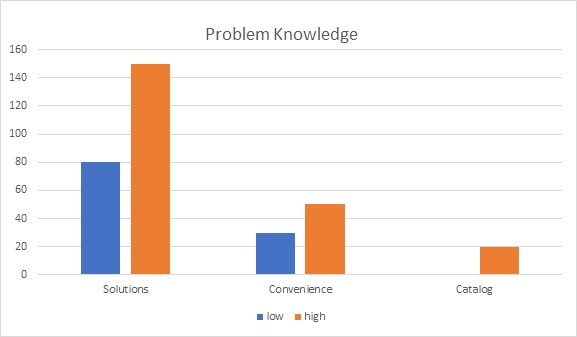

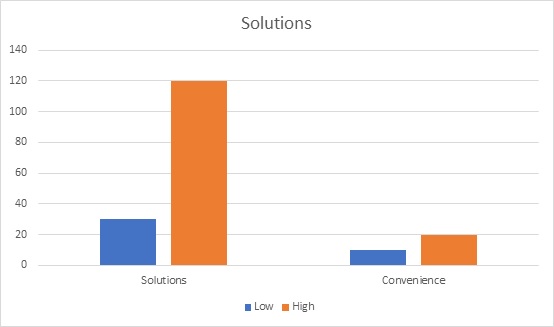

Each category has varying quantities of knowledge. In addition to the suppliers and purchasers there are architect/engineers (AEs), system OEMS, solutions distributors, convenience distributors, and catalog distributors.

There are varying degrees of knowledge of both the problem and solutions. The organized access to Value Propositions will be of considerable value to OEM system suppliers, architect Engineers, and various types of distributors.

Many value propositions need the input from more than just the purchaser. AEs and OEMS have knowledge the suppliers need to acquire. They may understand the problem better than the supplier. The solutions distributor is very likely to have insights relative to the problem.

Solutions distributors may also provide the solutions segment of the value proposition. They deal directly with the customer and have the details on the successes.

In fact, the suppliers will be well served to work with solutions distributors and prepare value propositions jointly.

Here are estimates of the knowledge prior to the value propositions.

The solutions distributor is very likely to have more knowledge of the customers’ problems than does the supplier. He is probably furnishing other products to address the problem. They can be complementary. If he also supplies piping around the valves or pumps, he has additional insights. He may even be providing the process equipment such as mixers or dryers which use the product.

Convenience and catalog distributors will be able to compensate for their lack of problem knowledge by linking to the supplier propositions on their websites.

Problem Knowledge Percent Compared to Supplier

The solutions distributor is likely to have completed value propositions for the supplier product which are relevant to the location and specific customer. The very fact that a supplier has solutions distributors rather than his own sales force indicates that he is not attempting to prioritize the solutions knowledge. His focus may be on achieving general product superiority. It is then up to the solutions distributor to create the value proposition for a specific case.

Where suppliers are using convenience or catalog distributors, there is the opportunity to prepare hundred or thousands of value propositions which the distributors can display through links. The choice of value propositions should be based on niche forecasts indicating opportunities of $10 million/yr. or more with 30% EBITDA and 20% market share.

Solutions Knowledge Percent Compared to Supplier at 100%

In some cases, the solutions distributor can create the value proposition with a package of products. If the distributor of a pump also provides a skid with the pump, valves, motors, and controls already assembled he changes the pump value proposition. The EBITDA for the package can easily exceed 30%. However, the pump manufacturer may not benefit. This is why several private equity firms have been acquiring combinations of pump, valve, and distribution companies capable of assembling skids.

The most valuable packages can be a product combined with continuous remote monitoring and guidance. Product suppliers seeking to increase EBITDA can do so if they are the package supplier and not a sub-contractor.

The value propositions are being posted in the AWE Productivity Hub. It is part of the Most Profitable Market Program.

Details are found at www.mcilvainecompany.com

Bob Mcilvaine can answer your questions at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.