NEWS RELEASE NOVEMBER 2015

430 Companies and Projects Will Account For 41 Percent of Industrial Scrubber Purchases

Sales of industrial scrubbers will be $6.8 billion in 2015. Suppliers who focus on 433 purchasers, engineering firms and large projects will be addressing 41 percent of the total potential. This is the conclusion reached by the McIlvaine Company in N008 Scrubber/Adsorber/Biofilter World Markets.

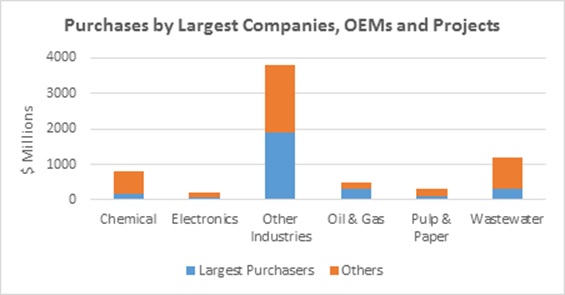

The scope of the report includes both wet and dry scrubbers as well as carbon adsorbers and biofilters. More than 40 percent of the market totaling $3 billion is concentrated in a few industries. Of a total scrubber market of $500 million in oil and gas, $300 million can be identified with 40 companies and projects.

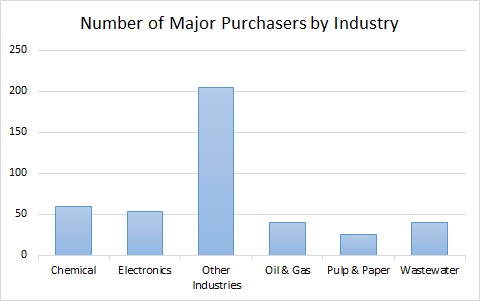

There are thousands of purchases of scrubbers. Many of the projects are quite small. However, 60 large companies and projects will address 20 percent of the chemical industry market of $80 million. Average purchases for the 50 will be $2.7 million creating an opportunity of $160 million.

In the “other industry” sector, 205 companies/projects have been identified whose purchases will average more than $9 million each. This includes large mining projects and steel complexes as well as the companies who own them.

There is a concentration among purchasers. For example, BASF will account for 1.8 percent of the scrubber purchases in the chemical sector. The top 10 chemical companies will account for 10 percent of the purchases. In the electronics sector, Samsung will be the leading purchaser. In the metals sector, ArcelorMittal which produces 6 percent of the world’s steel will be the leader.

In the oil and gas sector, five companies will account for 50 percent of the scrubber purchases. Ten engineering companies will be specifying or buying 30 percent of the scrubbers. There are some very large gas-to-liquids and refinery projects which will account for 20 percent of the scrubbers purchased for the sector. In many cases, the large purchasers are using the engineering firms who are designing the large projects, so there is an overlap. The result is that 40 companies and projects will account for scrubber purchases of $300 million.

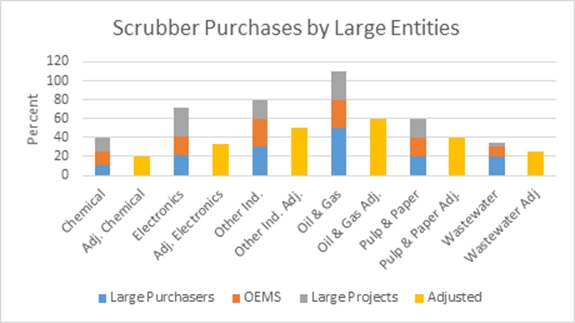

Large prospects, OEMs and large projects comprise a big share of the market. It varies by industry. In the oil and gas industry, the large purchasers account for 50 percent of the market. The large OEMs are addressing 30 percent. The large projects also address 30 percent. There is overlap with some large projects also involving large OEMs and large purchasers. The result is that the combination addresses an adjusted 60 percent of the total. By contrast, pulp and paper is 40 percent.

It is recommended that scrubber suppliers create specific programs to address this combination of companies and projects. The relatively small number of large opportunities makes a proactive approach possible. McIlvaine has created a unique route to market by combining the detailed forecasting in N008 Scrubber/Adsorber/Biofilter World Marketswith McIlvaine project tracking services.

For more information on contact Bob McIlvaine at This email address is being protected from spambots. You need JavaScript enabled to view it.