NEWS RELEASE NOVEMBER 2015

The Top 200 Purchasers Buy More Than 50 Percent of the World’s Water Treatment Chemicals

The largest users of water treatment chemicals are also the industries which are most concentrated. A few oil and gas companies produce most of the oil and gas. Large power companies produce most of the electricity. A few large electronics companies produce most of the semiconductors and flat panel displays. In fact, Samsung is a leader in both products.

Due to the government ownership of wastewater plants in many countries and the growth of third party operators such as Veolia and Suez, the water and wastewater industry is also relatively concentrated in terms of decision makers.

Water treatment chemical producers sell directly to some large users and sell through distributors to others. The percentage purchased by the large users is rising and calls for more focus on this segment by the producers. This is the conclusion reached by McIlvaine Company in N026 Water and Wastewater Treatment Chemicals: World Market.

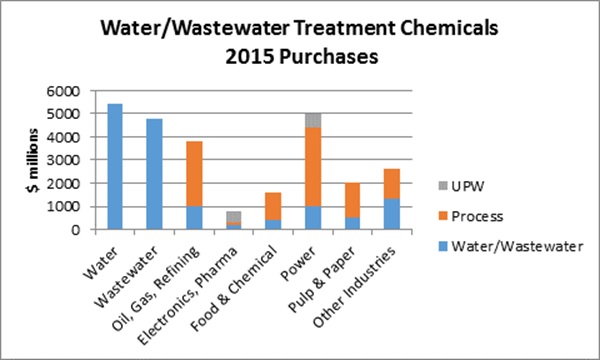

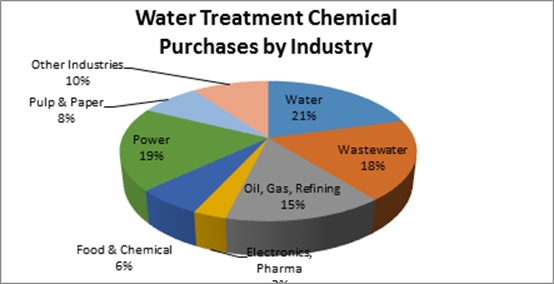

The 2015 treatment chemical sales will exceed $26 billion. Sales of chemicals to provide ultrapure water (UPW) will be $1.1 billion.

The electronics and power companies dominate the market for ion-exchange resins and other chemicals primarily used with ultrapure water. The UPW chemicals market includes $500 million of purchases by electronics and pharmaceutical manufacturers and $600 million by power plants. However, a few companies dominate the electronics business and they are among the largest UPW treatment chemicals purchasers.

| # | Company | Semi | Other Electronic | Power |

| 1 | Samsung | x | x | |

| 2 | Intel | x | ||

| 3 | TSMC | x | ||

| 4 | EDF | x | ||

| 5 | LGE | x | ||

| 6 | Sony | x | x | |

| 7 | SK Hynix | x | ||

| 8 | Micron | x | ||

| 9 | China Datang | x | ||

| 10 | China Guodian | x |

Samsung is the largest UPW treatment chemicals purchaser followed by Intel and TSMC. The largest power purchaser is EDF who ranks fourth.

For polymers and other chemicals used in UPW systems but also used elsewhere, the power plants rank above the semiconductor companies. The power companies are also large purchasers of corrosion inhibitors and anti scalants. Total treatment chemical purchases by power plants in 2015 will be $5 billion of which $3 billion will be spent by the coal-fired power generators.

There is subset of this group which also operates flue gas desulfurization (FGD) systems. This process expands the treatment chemical needs. This group is highly concentrated with just seven companies accounting for 44 percent of the treatment purchases.

|

Water and Wastewater Treatment Chemical Purchases by Coal-fired Power Companies with FGD |

|||||||

| # of Corp |

FGD capacity for each MW x 1000 |

Total MW 1000 |

% of Total Coal-fired Installed Base |

WWTC Purchases $ millions |

% of total $26 billion |

Examples | |

| 7 | Over 50 | 575 | 44 | 1,320 | 5 | Big 5 Chinese Corp | |

| 10 | 10-50 | 150 | 12 | 360 | 1.4 | AEP, TVA, Duke, Enel, EON | |

| 15 | 5-10 | 105 | 8 | 240 | 0.9 | NRG, Xcel, Tokyo Electric, Chubu Electric | |

| 20 | 3-5 | 80 | 6 | 180 | 0.7 | AES, EPDC, RWE, CEZ | |

| 52 | Sub total | 910 | 70 | 2,100 | 7 | ||

| 350 | 0-3 | 390 | 30 | 900 | 3 | U.S., Europe, China | |

| 404 | Total | 1,300 | 100 | 3,000 | 10 | ||

These seven companies will spend $1.3 billion for treatment chemicals this year. This represents 5 percent of all treatment chemical purchases. The average per company is 0.8 percent of total purchases. Other industries are also concentrated. The largest 200 companies across the various purchasing industries average more than 0.25 percent of the purchases. So in total they account for more than 50 percent of the market.

The McIlvaine Company has created a program for suppliers to maximize sales to the largest purchasers. It combines the treatment chemicals report with tracking of prospects and projects. Detailed Forecasting of Markets, Prospects and Projects.

For more information click on:N026 Water and Wastewater Treatment Chemicals: World Market

Other support services for the program include:

59EI Gas Turbine and Combined Cycle Supplier Program

N049 Oil, Gas, Shale and Refining Markets and Projects,

The new (Industrial Water Emitter) Industrial Water: Plants and Projects http://home.mcilvainecompany.com/index.php/databases/27-water/883-n033