NEWS RELEASE DECEMBER 2015

Gas Turbine Intake Filter Sales To Exceed $1 Billion By 2021

Sales of gas turbine intake filters will double over the next six years according to the McIlvaine Company. The high rate of revenue growth will be a function of not only robust unit growth but double digit growth in the revenue per unit.

Gas turbine power generation is increasingly attractive due to the low price of natural gas, the environmental restrictions on coal-fired power and the ability for system suppliers to deliver new plants within 24 months. The latest high performance turbines provide improved efficiency and lower CO2 emissions per unit of energy produced. However, the rotating equipment is subject to substantial corrosion and erosion from small particles.

As a result, the industry is moving from lower cost filters to those with HEPA efficiency. These filters often cost twice that of the lower efficiency filters and have somewhat shorter lives. This additional cost is more than offset by lower part replacement and less frequent washing. The specific climactic conditions vary from the arctic to the desert and from relatively clean air to air contaminated by hydrocarbons and fine particulate or salt water spray in the case of turbines on offshore rigs and coastal locations.

There are multiple approaches used to remove the air contaminants. In general they can be divided into static and pulsed filter systems. In static filter systems, there is a pre filter which captures most of the dust. It is low in cost and frequently replaced. The downstream high efficiency filter has a long life time due to the lower dust concentration to which it is exposed. There is a significant quantity of microglass media used in the high efficiency filters.

The pulsed filter approach provides filtration of coarse and fine particles in one device. The filter surface is periodically cleaned with a reverse pulse of air. Membrane filter media is commonly used with this approach.

The replacement filter market is larger than the new filter market.

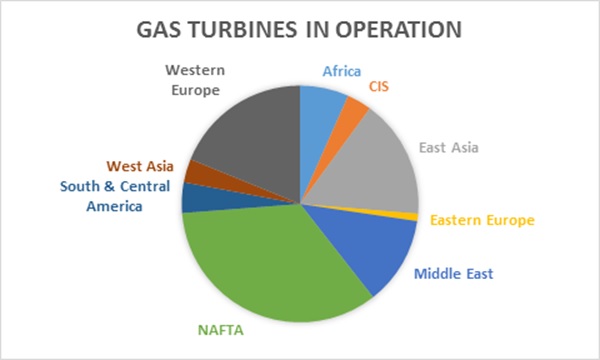

NAFTA is the largest regional market with 34 percent of the gas turbine installed base. Western Europe is the next largest segment but plants are shutting down there because of the high cost of gas in the region.

McIlvaine offers a customized program for suppliers which include detailed forecasts as well as information on all the existing and new opportunities. For more information on this program click on: 59EI Gas Turbine and Combined Cycle Supplier Program