NEWS RELEASE MARCH 2016

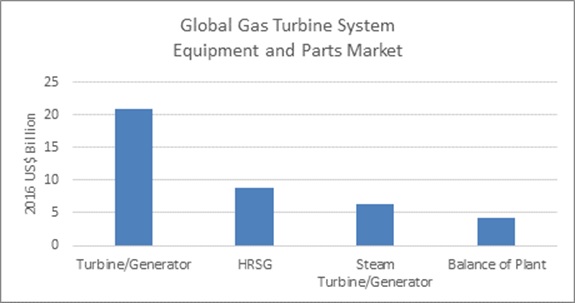

$40 Billion Gas Turbine System Equipment and Parts Market Will Be Impacted By Many Factors

The present market for gas turbine system equipment and parts is $40 billon. The market will grow faster than GDP over the next 10 years, but the rate of growth for systems is subject to a number of variables. The rate of growth for some individual products will be much higher. For example, the revenue for gas intake filters and high performance coatings will grow at double digit rates even if the number of units does not.

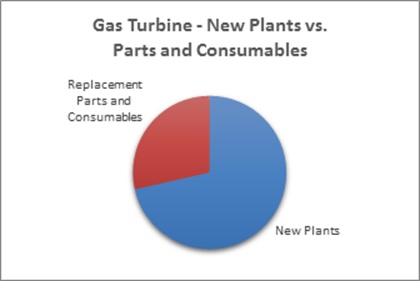

Due to normal operating temperatures, there is considerable deterioration of parts and need for replacement. The more recent practice of cycling operations as many as 200 times per year is creating flow accelerated corrosion (FAC) problems and increasing part deterioration rates. As a result, the present market for parts and consumables of US$11.5 billion will grow faster than the new plant market. Another reason for the comparative gain of parts over new product purchases is the increasing ratio of plants in place to new plants being constructed.

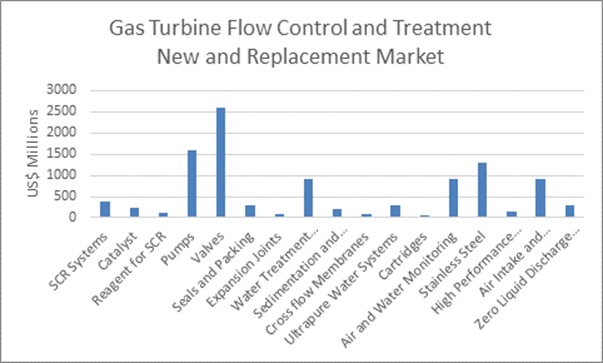

More than $4 billion will be spent for pumps and valves in 2016. Some of the product forecasts incorporate portions of other forecasts. For example the forecasts for stainless steel and high performance coatings are in part included in the pumps and valves forecasts.

There is a very large market for treatment chemicals including corrosion control and scale inhibitors. Intake water treatment for the steam and cooling systems, ultrapure water treatment for fogging nozzles, and wastewater treatment all require substantial yearly expenditures for chemicals.

The rate of growth for various products in coming years will be driven by a number of variables, including the following:

Drivers Impacting Future Markets for Gas Turbine Equipment and Parts

| Category | Factor | Driver | Market Impact |

| General | Fuel price | Low gas prices | Based on long term forecast not present prices |

| Alternative power generation | High cost of offshore wind, subsidies | Europe moving back to gas | |

| Electricity prices | Regulated vs. unregulated | Total cost of ownership | |

| Products | Air intake filters | Higher efficiency for turbine protection | Could boost market by 50% |

| SCRs | Regulations in Europe and elsewhere | Big increase in market where required | |

| Pumps | FAC and other cycling challenges | Market growing faster than total GT market | |

| Valves | FAC and other cycling challenges | Market growing faster than total GT market | |

| Seals | Pump, valve, compressor and new turbine designs | Market growing faster than total GT market | |

| Zero liquid discharge (ZLD) systems | Regulations, aridity and reluctance to wait for water permits | Growing market in U.S., China and elsewhere | |

| Stainless Steel | New turbine designs | Continuing opportunity for high performance materials | |

|

HRSGs and steam turbines |

Addition of steam tail to existing peakers to meet energy and greenhouse gas goals | Substantial market impact as many plants are upgrading | |

| Regulatory | Greenhouse gases | Limits or penalties on CO2 emissions | Negative impact on market vs. renewables but positive vs coal |

| Harm to aquatic life | Regulations forcing less intake and less once through water | ZLD, dry cooling, municipal water reuse | |

| Water discharge limits | U.S. has new regulations | More ZLD | |

| NOx emissions | Tough regulations in U.S. and potential new regulations in Europe | Steady positive impact on SCR and urea markets as prices are lowered in various countries |

Regulatory impacts will be important in determining not only the volume of products which will be sold but the margins at which those products will be sold. International suppliers will want to offer products at higher prices but with lower total cost of ownership than the local suppliers.

For suppliers, the primary thing to realize is that regulated utilities in the U.S. go through a rate-making process which guarantees a reasonable profit based on reasonable expenses. These utilities are going to be more interested in low cost solutions, otherwise the cost may not be fully accepted by a utility commission.

Unregulated entities, on the other hand, are much more market oriented and motivated by profit. These companies will be interested in cost effective solutions, which might include efficiency improvements or lower long term maintenance and operation cost improvements.

Detailed market forecasts of the total market are included in 59EI Gas Turbine and Combined Cycle Supplier Program

Forecasts for specific products are found in Markets

A webinar on March 10 at 10 a.m. CST will cover the market and many of the variables. It is free of charge. Click Here to Register