NEWS RELEASE August 2018

The Changing Market for Water Treatment Chemicals

Sales of water treatment chemicals will exceed $28.5 billion this year. This forecast includes a number of different chemicals such as biocides, flocculants, and corrosion/scale inhibitors. These totals are from the supplier perspective and include the revenues of the manufacturers plus the revenues of the formulators . They also include the traditional service supplied by companies such as Suez/GE, Ecolab/Nalco and Danaher/Chemtreat. They do not include revenues for distributors.

The market is changing due to

- Consolidation

- The advent of IIoT and Remote O&M

The purchase of GE Water Treatment by Suez and the BASF merger with Solenis are recent significant examples of consolidation but they follow others such as the Danaher purchase of Pall to add to its Hach and Chemtreat groups.

The advent of IIoT and remote O&M is facilitated by some of these mergers. Suez is already providing 24/7 monitoring of chemical usage at wastewater plants around the world. The GE chemicals acquisition gives it the opportunity to provide its own chemicals rather than purchase them. Danaher combines the Pall processes, the Hach monitoring and the Chemtreat chemicals.

The way these chemicals are sold varies greatly from industry to industry and product to product. There is a big contrast between coagulants and flocculants sold for municipal wastewater treatment and corrosion/scale inhibitors sold to power plants.

The world market for coagulants and flocculants for municipal wastewater treatment will exceed $ 3.2 billion this year. The majority of this market is held by large manufacturers of a narrow range of chemicals rather than formulators. Kemira holds the top position for coagulants where it estimates is share at 30 percent for coagulants and 20 percent for flocculants. Its annual water treatment chemical sales exceed $1 billion. Nearly half its sales come from just 50 customers (mostly municipalities including New York, Frankfurt, London, Paris, Shanghai and Singapore).

Large cities such as New York each represent only 1 or 2 percent of the U.S Municipal market. 7000 municipalities represent 85 percent of the total. An additional 9000 municipalities represent the balance. Each of the small plants average flows under 1 mgd. Worldwide the situation is somewhat different in that third parties are operating many plants. Veolia and Suez operate many municipal wastewater plants on various continents. BEWG of China has expanded to other countries. So the municipal market is characterized by the dominance of large suppliers for certain chemicals and widespread third party operations.

The opposite is true in the power industry. Fifty-five percent of the treatment chemicals for coal fired power plants are purchased by just 15 companies. Shenhua Guodian purchases more treatment chemicals than all the U.S. or European operators. The nuclear sector is even more consolidated. Just four companies purchase just under 40 percent of the total.

|

Nuclear Power Plant Combust, Flow and Treat Purchases 2018 - $ millions |

|||||

| World | EDF | Bechtel | KEPCO | Exelon | |

| Percent | 100 | 20 | 10 | 5 | 4 |

| Treatment Chemicals | 1400 | 280 | 140 | 70 | 56 |

Third party operation is also expanding in the power sector. Large plant suppliers such as MHPS and Doosan are moving into remote monitoring and operational support. ITOCHU/NAES is now operating hundreds of plants.

The power industry will spend $4.2 billion this year just for corrosion and scale inhibitors. Much of this will come from formulators who offer service and support as part of the sales price. This market is one of traditional strength for Suez/GE chemicals formerly Betz, Ecolab/Nalco, Solenis, Chemtreat, Buckman and other Formulators.

The term formulator is also synonymous with the application of knowledge about industries and processes. This skill is what will be needed in the post digital age empowered by the Industrial Internet of Wisdom. The knowledge about the industries and processes as well as about the chemicals can now be economically applied through remote monitoring, data analytics and the insights of subject matter ultra-experts. The details on how treatment chemicals companies are doing this is covered in a McIlvaine YouTube analysis https://youtu.be/YD5C93c6ujw.

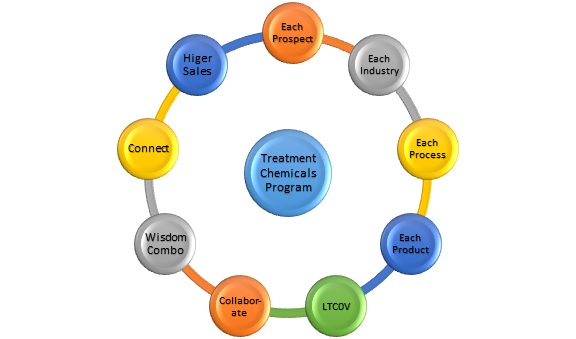

Treatment chemicals suppliers should be out in front leading the march into the post digital age and selling a wisdom based program to their customers. In the McIlvaine Water and Wastewater Treatment Chemicals report a program is analyzed and recommended. The program should address each prospect in each industry and each process within that industry as well as each supplier product which will have the lowest total cost of ownership (LTCO) for the operator. This LTCO validation ( LTCOV) is accomplished with collaboration and a combination of Wisdom tools which not only present the LTCO but validate it (LTCOV) by connecting with the individual purchasers. This is the route to higher sales.

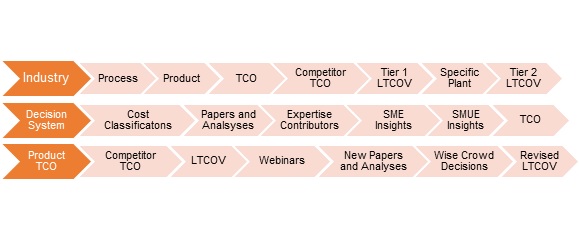

In the post digital age with experts analyzing an avalanche of data it will be possible to determine the total cost of ownership for each product in each process in each industry. The supplier can determine where he can validate the lowest total cost of ownership on a Tier 1 basis. Tier 1 is a general validation for most applications. In making a presentation to a specific customer the supplier should offer a Tier 2 LTCOV which takes into account variables such as local regulations and electricity cost differences between plants. In the U.S. the transfer of decision making for coal fired power plant regulations back to the States creates 50 x as many variables The LTCOV to be credible has to be backed up with papers and analyses most of which are already available but need to be made accessible. The LTCOV needs to be the product of decision systems with subject matter ultra-expert input. The Validation is a continuing process based on changing competitor offerings and industry developments which can be determined and analyzed through wise crowd decisions.

The N026 Water and Wastewater Treatment Chemicals: World Market provides 50,000 forecasts of the total available market and the basis for determining the Serviceable Obtainable Market and the Wisdom based Obtainable Market which includes the knowledge support and remote monitoring. It also includes forecasts of purchases by the top 200 customers. Additional consulting can help you prepare the right to win analysis and a procedure to implement the program and to keep it current. McIlvaine can also supply forecasts for 40,000 individual purchasers with the TAM forecasts but also some of the Tier 2 LTOCV factors. It can supply assistance to continually update the right to win analysis.

Details on the report are shown at N026 Water and Wastewater Treatment Chemicals: World Market. Bob McIlvaine is available to conduct a GoToMeeting on the report and program. Arrangements can be made by contacting him at This email address is being protected from spambots. You need JavaScript enabled to view it. 847 784 0012 ext. 122, mobile 847 226 2391