NEWS RELEASE November 2018

Big Coal Fired Power CFT Market is in the RCEP

Most of the new coal fired power plants will be built in Asia. The region already operates more coal fired power plants than the rest of the world. The U.S. has willingly given up its quest through the Trans Pacific Partnership to be a major player in the Asian coal fired power combust, flow, and treat (CFT) market. International CFT suppliers are unwillingly losing an advantage which will be difficult to overcome. A new trading group in Asia includes Chinese financing for plants throughout the region. The plant suppliers include a number of large Chinese companies.

The Trans-Pacific Partnership (TPP), which has now been rechristened the Comprehensive and Progressive Agreement for the Trans-Pacific Partnership (CPTPP) includes the Regional Comprehensive Economic Partnership (RCEP) – a free trade deal involving the ten members of ASEAN plus its six dialogue partners. If it succeeds, RCEP will become the world’s largest trading bloc, accounting for 3.4 billion people with a total Gross Domestic Product (GDP) of $49.5 trillion.

China has more than 40 percent of the existing coal fired boiler fleet. It has 80 percent of all the coal fired power plants less than 20 years old. This means that much of the experience with newer CFT designs resides in China.

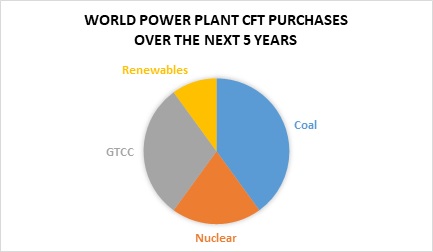

Coal fired power will remain the largest purchasing segment in the world power industry over the next five years.

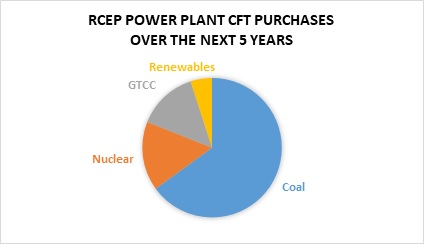

Most of the CFT purchases in RCEP power plants will be for coal fired generation.

Outside of the RCEP the two most active constructors of coal fired power plants are Turkey and Pakistan. Due to the China-Pakistan Economic Corridor plan and billions of dollars of Chinese funding for seventeen coal fired power plants, Pakistan is nominally part of this larger endeavor. China and Turkey have strengthened relationships and China is investing in Turkish power plants. So China is involved in all the regions with coal fired boiler construction activity.

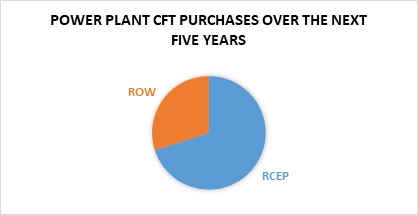

RCEP will be the major purchaser of power plant CFT over the next five years.

Environmental upgrades have been a good source of CFT business. For example a limestone scrubbing system for a coal fired plant requires an investment of more than $100 million. The addition of 200,000 MW of FGD systems in the U.S. spread out over three decades resulted in 40 billions of dollars of revenue for CFT companies. China has now installed over 900,000 MW of FGD systems. Other countries in RCEP will need another 400,000 MW of new and retrofit systems. India is presently retrofitting more than 50,000 MW of FGD.

Forecasts for this market are included in

N018 Electrostatic Precipitator World Market

N021 World Fabric Filter and Element Market

N027 FGD Market and Strategies

N056 Mercury Air Reduction Market

N031 Industrial IOT and Remote O&M

(including instrumentation and automation)

N029 Ultrapure Water: World Market

N028 Industrial Valves: World Market

N026 Water and Wastewater Treatment Chemicals: World Market

N031 Industrial IOT and Remote O&M

(including instrumentation and automation)

N024 Cartridge Filters: World Market

N006 Liquid Filtration and Media World Markets

N005 Sedimentation and Centrifugation World Markets

Bob McIlvaine can answer your questions at This email address is being protected from spambots. You need JavaScript enabled to view it. 847784 0012 ext. 122