NEWS RELEASE June 2019

$10 Billion Market for SCR Systems, Reagents and Catalyst

The power industry’s annual spending for SCR systems, catalysts and reagents will rise modestly from $9 billion this year to $10 billion in 2029. Sixty-seven percent of the purchases will be for Asian power plants.

There are presently 2 million MW of coal fired plants installed worldwide. This includes 1.2 million MW of SCR installations. There will be 30,000 MW of SCR retirements in the next decade. The coal fired base will increase by 270,000 MW in the next decade of which most will require SCR. This means total SCR will increase by 230,00O MW to over 1.4 million MW over the next decade.

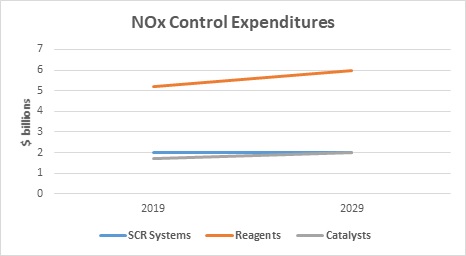

Expenditures for new SCR systems will be $20 billion or over $2 billion/yr. Expenditures for reagents will rise from $5.2 billion per year to over $6 billion. The yearly increase will be over 3 percent. The purchase of SCR catalysts will rise from $1.7 billion per year to over $2 billion by 2029.

More than 50 percent of the coal fired NOx control systems are in China. With the Guodian-Shenhua merger the combined company operates 14 percent of the world’s coal fired power SCR systems. It is the leading purchaser of NOx control equipment but is also a supplier to other utilities.

|

Catalyst and Reagent Purchases |

||

| Company | Reagent | Catalyst |

| Datang | 423 | 139 |

| Guodian/Shenhua | 726 | 238 |

| Huaneng | 544 | 179 |

| Huadian | 363 | 119 |

| NTPC | 189 | 62 |

| ENEL | 60 | 37 |

| J-Power | 30 | 10 |

| KEPCO | 142 | 46 |

| AECOM | 57 | 19 |

| AEP | 66 | 22 |

| BWE | 36 | 12 |

| Duke | 60 | 20 |

| NRG | 60 | 20 |

| Southern | 60 | 20 |

| Vietnam Power | 121 | 40 |

Most purchasers are spending far more for replacement catalyst than for new catalyst. The exception is NTPC who is installing many new SCR systems.

In the year 2000 China was importing nearly all the catalyst it required. Today the Chinese catalyst producers supply sufficient catalyst to meet domestic needs and also supply catalyst for export.

One of the future opportunities for international suppliers is the supply of catalytic filter elements. Haldor Topsoe and Filtration Group are leading the way with this important new technology which allows NOx reduction and particulate capture in the same device.

The market forecasts are continually updated in N035 NOx Control World Market

There are multiple tracking systems to identify each new project. A weekly Utility E-Alert provides the latest insights. The individual services which can be part of a package are linked below.

41F Utility E-Alert

59EI Gas Turbine and Reciprocating Engine Supplier Program

A program built around individual owner forecasts’ is explained at www.mcilvainecompany.com

Bob McIlvaine can answer your questions at 847 226 2391 or This email address is being protected from spambots. You need JavaScript enabled to view it.