NEWS RELEASE July 2019

Selling to the 500 Coal Plant Owners who make 99 percent of the Purchases

Suppliers of Combust, Flow, and Treat (CFT) products and services for coal fired power can now develop sales programs focused on each individual owner. Coal fired power represents one of the largest markets for CFT product suppliers. In the last 20 years an average of 50,000 MW per year of new coal fired power plants have been added to the world generation capacity. Over the next ten years 40,000 MW per year of new capacity will be added. This will be partially offset by retirement of 13,000 MW per year of existing capacity.

Annual new plant investment will exceed $160 billion per year. The installed base of plants has now reached 2 million MW and will increase by 270,000 MW over the next decade. The investment in the installed base exceeds $4 trillion. Potential for third party upgrades, repair, service, and remote operation will exceed $200 billion per year. This includes major environmental upgrades in India and other countries in Asia, Eastern Europe, and Africa.

McIlvaine has compiled enough information on each process at each plant to enable relatively precise forecasting as per the following example for valves.

| Corporate Name: EVN | Unit size: MW 660 |

| Plant Name: Genco 3 Vinh Tan 2 | Vĩnh Tân commune, Tuy Phong district, Bình Thuận province. Vietnam |

| Unit # 1 | Specific product purchases 2019 $1000 |

| Forecasts can be supplied for sixteen types of valves, four types of pumps, actuators, limestone, lime, precipitator internals, dust bags, gas instrumentation, liquid instrumentation, controls, treatment chemicals, ammonia, urea, catalyst, cartridges, dewatering filter belts, membrane modules, linings, nozzles, mist eliminators, fans, air compressors, oxidation compressors, motors, VFD, seals, packing, hose, couplings, compressed air filters, lubrication filters | Ball valves $170,000 |

| Butterfly Valves: $120,000 | |

| Globe Valves $190,000 | |

| Plug Valves: $100,000 | |

| Gate Valves: $150,000 |

Seventy percent of the purchasing decisions for existing plants are made by 27 companies with more than 10,000 MW of capacity. However, 150 owners are making the decisions for 70 percent of the new plants. Five hundred owners will purchase 99 perent of CFT products for new and existing plants.

| Coal Fired Capacity for Individual Owners | ||

| Above MW | Planned Cumulative # | Operating Cumulative # |

| 80,000 | 1 | |

| 60,000 | 2 | |

| 50,000 | 3 | |

| 40,000 | 3 | |

| 30,000 | 8 | |

| 20,000 | 2 | 10 |

| 10,000 | 8 | 27 |

| 5000 | 25 | 63 |

| 3000 | 50 | 110 |

| 2000 | 70 | 164 |

| 1500 | 90 | 196 |

| 1000 | 150 | 255 |

| 700 | 200 | 307 |

| 500 | 250 | 379 |

| 300 | 300 | 491 |

| 200 | 350 | 570 |

| 100 | 400 | 710 |

| ˂ 100 | 900 | |

Country Forecasts are based on aggregating forecasts for individual owners.

| Coal Plants by Country (MW) Installed Base | |||||||

| Country | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

| Albania | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Argentina | 350 | 350 | 350 | 350 | 350 | 350 | 350 |

| Australia | 24,442 | 24,442 | 24,442 | 24,442 | 24,442 | 24,442 | 24,442 |

| Austria | 635 | 635 | 635 | 635 | 635 | 635 | 635 |

| Bangladesh | 525 | 1,200 | 2,500 | 5,500 | 8,000 | 10,000 | 12,000 |

| Belarus | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Belgium | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Bosnia & Herzegovina | 2,073 | 2,073 | 2,073 | 2,073 | 2,073 | 3,000 | 4,000 |

| Botswana | 600 | 600 | 732 | 732 | 732 | 1,200 | 1,200 |

| Brazil | 2,804 | 2,804 | 2,804 | 2,804 | 2,804 | 3,400 | 3,400 |

|

|||||||

|

|||||||

|

|||||||

Brazil Plant Details

| Unit | Sponsor | Parent | Capacity (MW) | Year | City | State |

| MPX Itaqui power project | Eneva | E.ON, EBX Group | 360 | 2013 | Itaqui | Maranhão |

| Porto do Pecém I Unit 1 | Eneva, EDP Energias do Brasil | Eneva, EDP | 365 | 2012 | São Gonçalo do Amarante | Ceará |

| Porto do Pecém I Unit 2 | Eneva, EDP Energias do Brasil | Eneva, EDP | 365 | 2013 | São Gonçalo do Amarante | Ceará |

| Porto do Pecém II Unit 1 | Eneva | E.ON, Eneva | 365 | 2013 | São Gonçalo do Amarante | Ceará |

| Porto do Pecém-1Unit 1 | EDP Energias do Brasil | EDP | 365 | 2012 | São Goncalo do Amarante | Ceará |

| Porto do Pecém-1 Unit 2 | EDP Energias do Brasil | EDP | 365 | 2013 | São Goncalo do Amarante | Ceará |

| Porto do Pecém-2 Unit 1 | Eneva | E.ON, EBX Group | 365 | 2013 | São Goncalo do Amarante | Ceará |

| Presidente Médici-A Unit 1 | Companhia de Geração Térmica de Energia Elétrica | Eletrobras | 63 | 1974 | Candiota | Rio Grande do Sul |

| Presidente Médici-A Unit 2 | Companhia de Geração Térmica de Energia Elétrica | Eletrobras | 63 | 1974 | Candiota | Rio Grande do Sul |

| Presidente Médici-B Unit 1 | Companhia de Geração Térmica de Energia Elétrica | Eletrobras | 160 | 1986 | Candiota | Rio Grande do Sul |

| Presidente Médici-B Unit 2 | Companhia de Geração Térmica de Energia Elétrica | Eletrobras | 160 | 1987 | Candiota | Rio Grande do Sul |

| Presidente Médici-C Unit 1 | Companhia de Geração Térmica de Energia Elétrica | Electrobras | 350 | 2010 | Candiota | Rio Grande do Sul |

High quality forecasts now allow a supplier to project purchases for each owner. A large percentage of coal plant CFT products are purchased based on decisions of a group and a consensus built up over time. Therefore the continuous pursuit rather than response to a sales lead is more productive The larger purchasers can be pursued differently than those in the middle or those at the bottom. Here are utilities in the middle with 6000 – 9000 MW range of existing and planned capacity. J Power is the only company appearing on both lists.

| Planned Coal Fired | |

| Company | MW |

| Power Finance Corporation | 8,000 |

| Egyptian Electricity Holding Company | 7,920 |

| KEPCO | 7,698 |

| China Resources | 7,035 |

| NLC India | 6,700 |

| TANGEDCO | 6,640 |

| J-POWER | 6,356 |

| Eskom | 6,352 |

| UPRVUNL | 6,270 |

| Operating Coal Fired | |

| Company | MW |

| E.ON | 8,772 |

| J-POWER | 8,482 |

| Inter RAO | 8,372 |

| Vedanta Resources | 8,327 |

| Xcel Energy | 7,915 |

| Henan Investment Group | 7,840 |

| Beijing Energy Group | 7,772 |

| Engie | 7,387 |

| Damodar Valley Corporation | 7,240 |

| AES | 7,025 |

The CFT purchases can all be related to existing and new MW. Details on each process for each owner also are important. McIlvaine has details on FGD, SCR, precipitators, fabric filters, and other components in databases which have been compiled and augmented since the 1970s.

The combustion segmentations are by boiler design e.g. fluid bed or pulverized coal. Also the efficiency division: subcritical, supercritical, and ultra-supercritical is important. China is upgrading more than 100,000 MW of sub critical and supercritical to ultrasupercritical.

Intake water, boiler feedwater, type of cooling, wet FGD, and wastewater treatment can be identified. A number of plants are improving their wastewater treatment and often opting for zero liquid discharge and maximum water reuse.

Solid waste is a challenge due to increasingly stringent standards. Switching from wet to dry flyash handling and dewatering ponded flyash are major opportunities. Byproduct sales potential is also a driver.

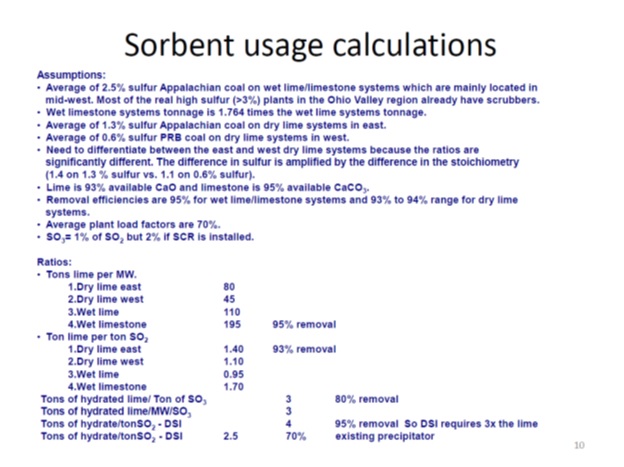

Various air pollution control approaches are used for reducing SO2, NOx, particulate, mercury, VOCs and even CO2 (sequestering). It is impossible to make precise determinations for each plant because of variations in the fuel and other site specific factors. Rules of thumb provide a relatively accurate way of forecasting as per the following sorbent example.

The coal fired power industry is unique in that relatively few companies make nearly all the purchases. Details on their operations are available. This means that a CFT supplier can structure his sales program around these specific companies and pursue the most profitable markets. This program is explained at www.mcilvainecompany.com.

Details on coal plants by country and on the individual plants are tabulated in 42EI Utility Tracking System.

Bob McIlvaine can answer your questions at 847 784 0013, cell 847 226 2391, email This email address is being protected from spambots. You need JavaScript enabled to view it.