NEWS RELEASE MARCH 2012

Liquid Treatment and Flow Control Market Remains Fractured

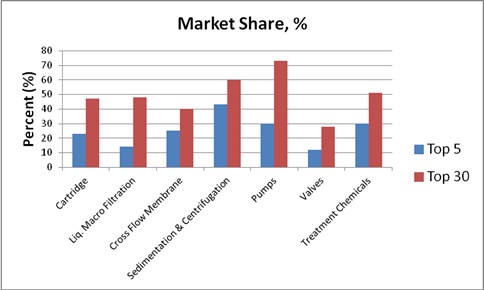

Despite considerable consolidation in the last decade the market for equipment and consumables to clarify and move liquids remains fractured. No company enjoys more than a few percent of the total market. No company has more than 15 percent of any market segment. In each segment the market share of the top 5 companies ranges from 12 to 43 percent. Market shares for the top 30 companies range from 28 to 73 percent in the seven major segments. This is the conclusion reached by the McIlvaine Company through comparison of its analyses in a number of specific market reports it publishes.

|

Segment |

Group |

Sales $ Millions |

Total Segment Sales $ Millions |

Market Share % |

|

Cartridge |

Top 5 |

3,500 |

15,000 |

23 |

|

Cartridge |

Top 30 |

7,000 |

15,000 |

47 |

|

Liquid Macrofiltration |

Top 5 |

900 |

6,300 |

14 |

|

Liquid Macrofiltration |

Top 30 |

3,000 |

6,300 |

48 |

|

Cross-flow Membranes |

Top 5 |

2,500 |

10,200 |

25 |

|

Cross-flow Membranes |

Top 30 |

4,000 |

10,200 |

40 |

|

Sedimentation/ Centrifugation |

Top 5 |

3,000 |

7,000 |

43 |

|

Sedimentation/ Centrifugation |

Top 30 |

4,200 |

7,000 |

60 |

|

Pumps |

Top 5 |

11,200 |

37,200 |

30 |

|

Pumps |

Top 30 |

27,300 |

37,200 |

73 |

|

Valves |

Top 5 |

6,400 |

53,100 |

12 |

|

Valves |

Top 30 |

14,700 |

53,100 |

28 |

|

Treatment Chemicals |

Top 5 |

7,200 |

23,900 |

30 |

|

Treatment Chemicals |

Top 30 |

12,300 |

23,900 |

51 |

GE is one of the few companies in most sectors. With its acquisition of Dresser, it gained considerable valve market share. The acquisition of Betz decades ago made it a top player in treatment chemicals. It has also purchased a number of companies making filtration equipment. Large pump players such as Xylem have small market shares in the other segments.

Dow chemical is the leading supplier of membranes for reverse osmosis systems but does not supply the systems. Dow is a major supplier of chemicals but not filtration equipment.

One reason for the lack of concentration is the diversity of product requirements. An inexpensive pump to handle 2 gpm of clear water bears little resemblance to a 50,000 gpm slurry pump used in a flue gas desulfurization system. The complex highly machined and balanced centrifuge is far different than a simple clarifier but both are included in the sedimentation and centrifugation category. Alfa Laval and GEA enjoy a large market share in the disk stack centrifuge sub sector but are not leaders in hydro-cyclones, clarifiers, or dissolved air flotation which is also included in the category.

Market shares in each of the seven product areas are included in the following McIlvaine market reports:

Cartridge Filters: World Market click on: http://www.mcilvainecompany.com//brochures/water.html#nO24

Industrial Valves: World Markets click on: http://www.mcilvainecompany.com/brochures/water.html#n028

Liquid Filtration and Media World Markets, click on: http://www.mcilvainecompany.com/brochures/water.html#n006

Pumps World Markets click on: http://www.mcilvainecompany.com/brochures/water.html#N019

RO, UF, MF World Market http://www.mcilvainecompany.com/brochures/water.html#no20

Sedimentation/Centrifugation World Markets, click on: http://www.mcilvainecompany.com/brochures/water.html#n005

Water and Wastewater Treatment Chemicals: World Market click on: