NEWS RELEASE AUGUST 2015

Oil Prices to Have Minor Impact on the Market for Scrubbers and Absorbers

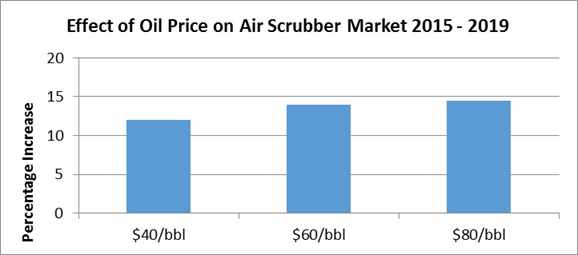

The market for scrubbers and absorbers for industrial plants will grow by over 14 percent from 2015 to 2019 at oil prices of $80/barrel during the period. At $40/barrel, the growth will only be 12 percent. This the latest forecast inN008 Scrubber/Adsorber/Biofilter World Marketspublished by the McIlvaine Company.

There are a number of variables which will determine the market growth for scrubbers, adsorbers, biofilters and absorbers. New insights are continually generated which justify changes in the forecasts. The Iran nuclear agreement is just one example. The plunging economy in China is another. However, the most significant development recently is the plunge in oil prices to $40/barrel.

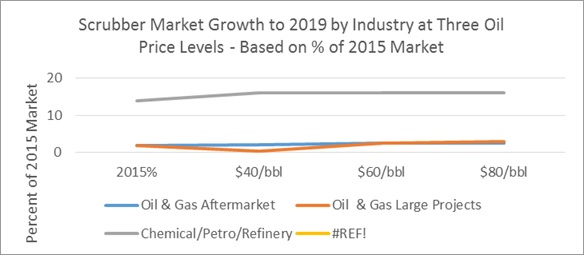

Presently, oil and gas only account for 4 percent of the scrubber/absorber revenues. However, a legitimate question is whether lower oil prices will affect other scrubber markets. The impact of future oil prices on the market can be best predicted by estimating the impact on the individual segments.

Oil and gas can be divided into two segments. The aftermarket and routine purchases for small projects represent only 2 percent of the 2015 market. The longer term large project revenues also represent only 2 percent of the current market. If the price of oil were to continue to remain at $40/barrel through 2019, revenues for this segment would shrink over the period by 75 percent to an amount equivalent to only 0.5 percent of the total 2015 market. The biggest regional impact would be in Canada where many scrubbers are used in oil sand extraction.

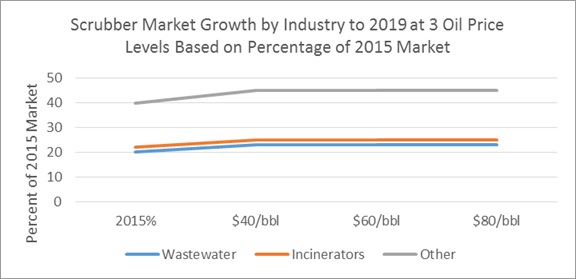

The petrochemical market will grow at $40 oil. Municipal wastewater is one of the big scrubber markets due to the need for odor control at each plant. This market will be unaffected by the fluctuation in oil prices.

Lower prices will result in more gasoline being consumed and more oil which needs to be refined. Therefore, scrubber sales to refineries will be unaffected.

Municipal and industrial solid waste combustor scrubber sales are slated to account for 22 percent of 2015 scrubber revenues. This market will be unaffected by lower oil prices and will rise to the equivalent of 25 percent of the 2015 market by 2019.

McIlvaine will continue to assess the likely changes in oil prices based on the following factors:

- The break-even cost for a new well

- Hydraulic fracturing break-even point is $30 to $50/barrel equivalent based on improved management practices and the extraction of more product from existing wells.

- Oil and tar sands projects break even at $65/barrel.

- Subsea is more expensive.

- New technology developments

- Bechtel experience with coal seam gas to LNG in Australia indicates lower break- even costs than subsea extraction.

- China coal to syngas and chemicals could be an alternative which is more than competitive at $40 oil. McIlvaine has recommended marrying the two stage (HCl/SO2) scrubbing along with conventional hydrochloric acid leaching to extract rare earths and generate byproduct revenue.

- Demand

- The slowdown in China could impact demand as could economic problems in Greece and other countries.

- Demand is a function of industrial activity. There is little activity needed to extract Saudi oil. On the other hand, over 2,000 companies rely on the Alberta oil sands market for their revenues. The greater the industrial activity the greater the oil demand.

- Supply

- Saudi Arabia could choose to restrict production. In many ways the situation is analogous to the gold in Ft. Knox. You could sell it at any price and generate positive cash flow. However, it is a precious and finite resource which is important to future generations.

- Market driven companies will typically be reactive rather than proactive and will only increase drilling after oil prices rise to a level to make drilling profitable.

- Political developments

- Lifting the Iran embargo on oil exports.

- Russian activities in the Ukraine and elsewhere.

- Chinese efforts to manage the economy.

- Uncertainties in North Korea, Greece and Venezuela.

- Regulatory initiatives

- Export restrictions.

- Climate change regulations.

- Pollution control requirements for hydraulic fracturing.

- Traumatic events

- Major oil spills.

- Large meteorite impact, earthquake or major volcano eruption.

Some of these developments are more predictable than others. The low oil prices lead to lower extraction activity which eventually leads to shortages and higher prices. On the other hand, wars, oil spills and earthquakes cannot be easily predicted. As a result there will be the need for continuous changes in the forecasts to take into account the surprises.

For more information on N008 Scrubber/Adsorber/Biofilter World Markets, click http://home.mcilvainecompany.com/index.php/services-drop-down