NEWS RELEASE MARCH 2011

World Coal-fired Generators Will Complete 340 Air Pollution Upgrades Worth $21 Billion in 2011

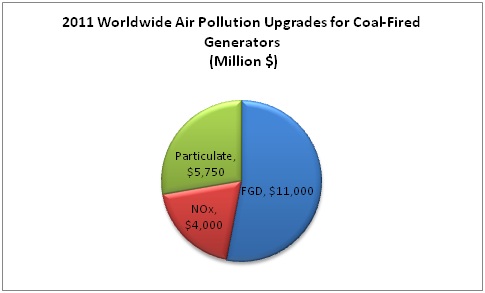

There are 340 large air pollution upgrade projects due to be completed in 2011. The utility investment in these projects will exceed $21 billion. These projects are each listed in a pair of McIlvaine databases. Utility Environmental Upgrade Tracking System covers the entire world except China. Because China is such a booming market, it is treated separately in Chinese Utility Plans. The latter is published in both English and Chinese.

These are only projects to retrofit air pollution control equipment at existing plants. There is an equally active market for air pollution control equipment for new plants. In general, the retrofit activity for FGD and particulate is in the U.S. and Europe. Most of the investment in China is for new plants, but for densely populated areas there is a program to utilize selective catalytic reduction (SCR) systems to reduce NOx.

In the U.S. the retrofits will be modest this year. However, the next few years will be very active with hundreds of projects slated. A new utility air toxic rule is about to be promulgated. The uncertainty slowed investment in 2011 but still does not change the 2014 need to install the equipment. So, in the 2012-14 period, the U.S. will be the leading purchaser of air pollution control equipment.

There are few retrofit projects in India but there are many projects associated with new coal-fired boilers. Most of the activity in Europe is in the East.

The predominant technology for flue gas desulfurization (FGD) is wet scrubbing using ground limestone. This will require big investments in rotating items such as ball mills, pumps and fans. There are few suppliers of this large equipment. In the past when orders have surged, it is these items which have led to delays. The amount of readily available high quality limestone is diminishing as existing users have contracted for the supplies available. This is leading to concepts involving regional grinding and transport.

The forecasts for NOx are for the initial hardware and not the consumables such as catalyst and ammonia. Most of the retrofit projects utilize selective catalytic reduction (SCR). Less than 10 percent of the NOx projects will utilize selective non-catalytic reduction (SNCR).

Some of the particulate projects involve upgrades of existing electrostatic precipitators. Others involve replacing the precipitators with fabric filters. This allows more flexibility in fuel selection with confidence of meeting emission requirements.

For more information on Utility Environmental Upgrade Tracking System, click on: http://www.mcilvainecompany.com/brochures/energy.html#42ei and Chinese Utility Plans, click on: http://www.mcilvainecompany.com/brochures/energy.html