NEWS RELEASE MAY 2011

Consolidation in $7 Billion Air Filtration Market

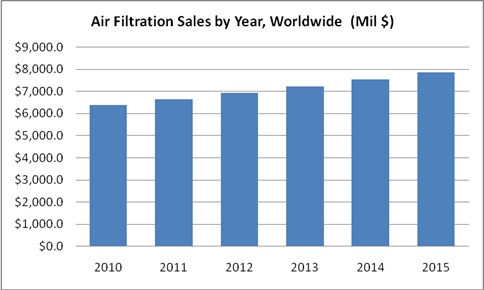

Sales of air filters will rise from $6.6 billion this year to close to $8 billion by 2015. This is the latest forecast in the online continually updated Air Filtration and Purification World Markets published by the McIlvaine Company.

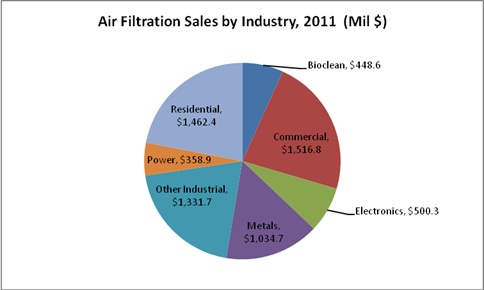

Air Filtration Sales by Industry, 2011 ($ Million)

|

Bioclean |

$448.6 |

|

Commercial |

$1,516.8 |

|

Electronics |

$500.3 |

|

Metals |

$1,034.7 |

|

Other Industrial |

$1,331.7 |

|

Power |

$358.9 |

|

Residential |

$1,462.4 |

Air Filtration Sales by Year, Worldwide ($ Million)

|

2010 |

$6,387.9 |

|

2011 |

$6,653.5 |

|

2012 |

$6,930.6 |

|

2013 |

$7,217.8 |

|

2014 |

$7,531.6 |

|

2015 |

$7,866.8 |

Over the next five years there will be increased consolidation among suppliers of finished filters and filter media. The opposite is true at the front of the chain. The number of companies supplying materials used to make the filter media will actually increase. This is because of the expansion of the industry to new materials. For example, there are only a few major suppliers of micro glass fibers to make high efficiency particulate (HEPA) filters. These materials were used in nearly all HEPA filters a decade ago. Now membranes offer an alternative. There are a number of membrane suppliers who are now selling HEPA grade materials.

There are opportunities to develop materials which not only filter and separate particulates but also adsorb volatile organic compounds. There are materials which can combine filtration with catalytic oxidation of organic gases. Many applications from residential through semiconductor manufacturing require treatment of both particulates and gases.

Another trend is toward vertical integration. The most recent example is Clarcor. In January Clarcor, one of the largest filter companies, acquired a filter media maker. Norm Johnson, Chairman, stated “We believe that Transweb adds significantly to our technological capabilities and offers outstanding opportunities to enhance the product offerings of many of our filtration operating companies.”

Geographical expansion is another major trend. Many of the filter suppliers and media companies have set up operations in China. Air filters used in residential and commercial buildings have a low price to volume ratio. Therefore, shipping costs are relatively high. This dictates location of manufacturing near the buyer. One example of wide geographic supply is American Air Filter (AAF), a subsidiary of Daikin. With the acquisition of Nippon Muki in 2009, Daikin moved closer to its goal to “gain the No. 1 position in the global air filter business”.

Donaldson Company has strategically positioned its manufacturing facilities around the world. It is now constructing a second manufacturing facility in Aguascalientes, Mexico. This new 140,000 square foot facility will manufacture air filters for the company's growing markets in the Americas. Donaldson's existing plant in Aguascalientes, which currently manufactures both air and liquid filters, will specialize in liquid filters upon the completion of this new air filter plant.

Hollingsworth & Vose has successful media manufacturing facilities in China and is expanding in Asia. In February H&V formed a joint venture with Nath Group and plans to establish manufacturing capability in India. The plan includes construction of a new mill near Aurangabad, Maharashtra which will make HVAC media.

For more information on Air Filtration and Purification World Markets, click on: http://www.mcilvainecompany.com/brochures/air.html#n022